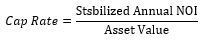

The Cap Rate, or Capitalization Rate, is the percentage derived from a stabilized asset’s annual NOI divided by its purchase price.

Investors often look to cap rates that have been set in the market to begin getting a ball park idea of what they might pay for an asset they are looking to invest in. For example, an investor is looking at a Class A office asset in X market. Class A office buildings in X market have been trading between a 5% – 6% cap rate over the past 6 months, so an investor may look to his or her first year of projected NOI and divide that by a cap rate of somewhere between 5% – 6% to get an idea of the price he or she might need to pay.