Commercial real estate loan provisions can be a frustrating aspect of the loan process for borrowers. While they are intended to protect the lender’s interests and ensure that the borrower can repay the loan, these provisions don’t always align with the realities of the commercial real estate market.

One of the most common examples of this disconnect is the loan-to-value (LTV) ratio. This ratio compares the value of the property to the amount of the loan, with a higher LTV indicating that the borrower has less equity in the property. Lenders often have strict LTV requirements, with many requiring a maximum LTV of 75-80%.

However, the value of a commercial property can fluctuate significantly over time, and the LTV calculation is often based on the property’s value at the time the loan is originated. This can create problems for borrowers if the property’s value decreases after the loan is issued, resulting in a higher LTV and increased risk for the lender.

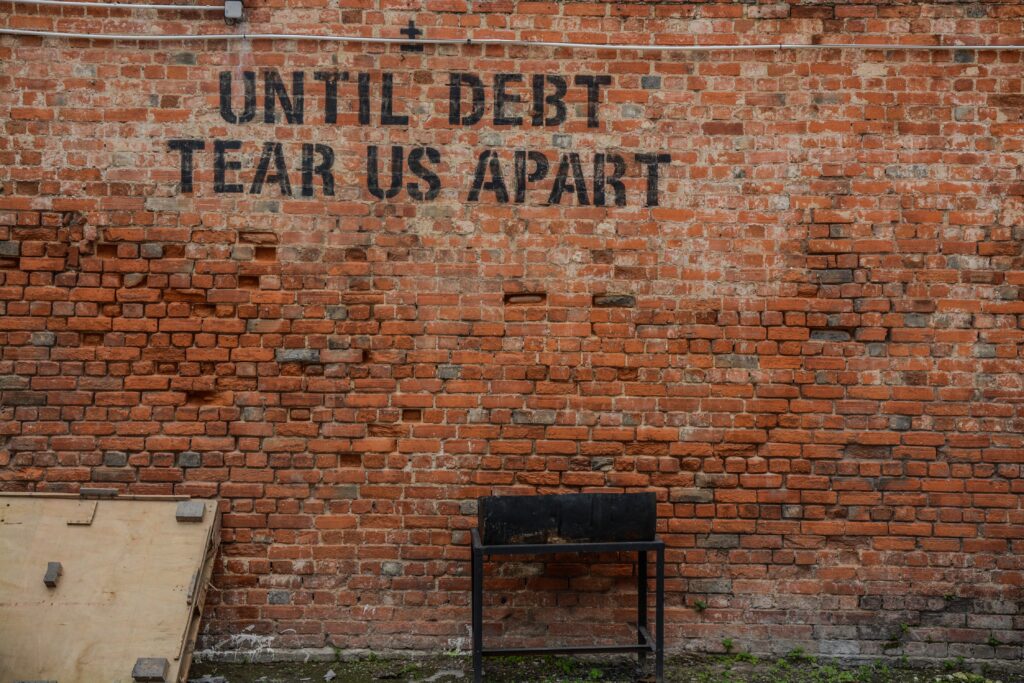

Another issue with commercial real estate loan provisions is that they can be inflexible. Many loans have fixed repayment terms and amortization schedules, which can make it difficult for borrowers to adjust to changes in the market or their own financial situation. This inflexibility can put undue strain on borrowers and ultimately lead to default.

Additionally, commercial real estate loan provisions often prioritize the lender’s interests over those of the borrower. For example, many loans include personal guarantees, which can put the borrower’s personal assets at risk if they are unable to repay the loan. This can be particularly concerning for small business owners who may not have significant assets to protect.

Overall, while commercial real estate loan provisions are intended to protect the lender and ensure the borrower’s ability to repay the loan, they don’t always align with the realities of the market. This can create challenges for borrowers and lead to difficulties in securing and repaying a commercial real estate loan